28+ Online income tax calculator

Annual income coming from salary and other profits. Total income tax -12312.

Vehicle Gasoline Log Download And Print Pdf Document Fuel Mileage Printables Budgeting Worksheets

Calculate the tax payable for the financial year at the applicable income tax slab rate for FY 2022-23.

. Income tax calculator is an online tool designed to do help with basic Income tax calculation as per New tax regime vis-a-vis Old tax regime. The Income Tax Calculator considers factors like your income age interest. Avalara AvaTax can help you automate sales tax rate calculation and filing preparation.

Ad Get the benefit of tax research and calculation experts with Avalara AvaTax software. The Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. The Tax Caculator Philipines 2022 is using the latest BIR Income Tax Table as well as SSS PhilHealth and Pag-IBIG Monthy Contribution Tables for the computation.

Estimate your federal income tax withholding. Using an income tax calculator you can calculate the tax liability based on the following points -. A tax calculator for the 2022 tax year including salary bonus travel allowance pension and annuity for different periods and age groups.

You can enter the. Information relates to the law prevailing in the year of publication as indicated Viewers are advised to ascertain the correct positionprevailing law before relying upon any document. Earning from other sources like.

New York state tax 3925. As your total income goes up youll pay federal income tax on a portion of the benefits while the rest of your. Marginal tax rate 633.

Calculate the Tax Payable. NIS Non-taxable allowance Chargeable Income and the taxes deducted as per the 28 and 40 tax bands are generated automatically. Finance Act 2020 vide.

Ad Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. However a free income tax calculator 2019 and 2020 will be a great support to calculate such amount of tax. The Year to Date calculations eg.

Calculate the taxes already paid during the financial year. But calculating your weekly take-home pay. If you make 55000 a year living in the region of New York USA you will be taxed 11959.

SARS Income Tax Calculator for 2023 Work out salary tax PAYE UIF taxable income and what tax rates you will pay. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. An Income Tax Calculator is an online tool you can use to assess your tax liability as per the relevant tax laws.

See What Credits and Deductions Apply to You. See where that hard-earned money goes - with Federal Income Tax Social Security and other. These rates are applicable for the assessment year 2022-23 during which taxes for the year 2021-22 are.

Use Our Free Powerful Software to Estimate Your Taxes. For TurboTax Live Full Service your tax expert will amend your 2021 tax return for you through 11302022. It can be found on certain documents.

Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Use this tool to. 0 whenever an ordinary income marginal tax rate is 10 or 15.

You will need a reference number before you can pay tax on your vehicle. Social Security benefits are 100 tax-free when your income is low. After 11302022 TurboTax Live Full Service customers will be able to amend their.

How Your Paycheck Works. See how your refund take-home pay or tax due are affected by withholding amount. Effective tax rate 561.

Ad Enter Your Tax Information. Tim uses your answers to complete your income tax return. Income Tax Withholding When you start a new job or get a raise youll agree to either an hourly wage or an annual salary.

Chapter 62F statute requires distribution of the credits in proportion to personal income tax liability in Massachusetts incurred by taxpayers in the immediately preceding taxable year. 2022 Tax Calculator 01 March. You can pay car tax online using the DVLA website.

That means that your net pay will be 43041 per year or 3587 per month. How to use BIR Tax.

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Paycheck Excel Good Essay

28 Sample Income And Expense Statements In Pdf Ms Word

Payslip Templates 28 Free Printable Excel Word For Writing Practice Worksheets Kindergarten Subtraction Worksheets Kindergarten Worksheets Free Printables

Xtool D7 Auto Obd2 Scanner Full Systems Diagnostic Key Programmer 28 Services Ebay

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Pay Calculator Salary

28 Sample Income And Expense Statements In Pdf Ms Word

Equipment Maintenance List Templates 7 Free Xlsx Docs Formats List Template Templates Worksheet Template

Real Estate Commission Calculator Templates 8 Free Docs Xlsx Pdf Real Estate Training Real Estate Templates

Office Supply Inventory Templates 10 Free Xlsx Docs Pdf Excel Housekeeping Templates

Purchase Requisition Form Templates 10 Free Xlsx Doc Pdf Formats College Application Essay Templates Excel Templates

Inventory Analysis Templates 8 Free Docs Xlsx Pdf Excel Analysis Templates

Trip Budget Template The Truth About Trip Budget Template Is About To Be Revealed Budget Template Budgeting Budget Travel

Payslip Templates 28 Free Printable Excel Word Formats Templates Professional Templates Excel

Thinkcar Thinktool Pro Car Full System Obd2 Diagnostic Scanner Ecu Coding Tool Ebay

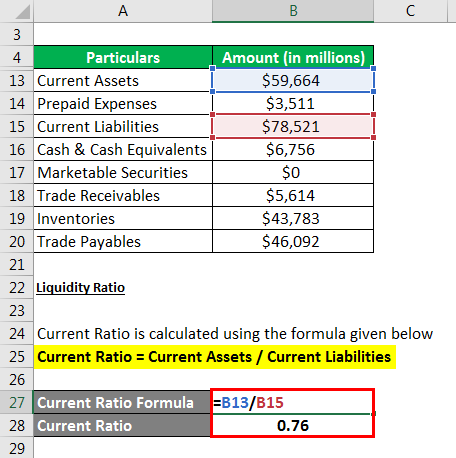

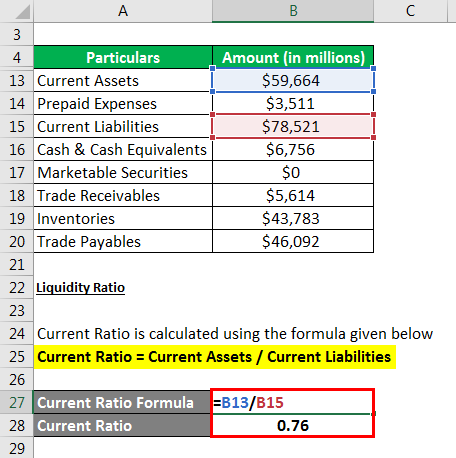

Accounting Ratio Formula Complete Guide On Accounting Ratio Formula

Thinkcar Thinktool Pro All Systems Bluetooth Obd2 Diagnostic Scan Tool 2 Years Free Update 28 Resets Bi Directional Ecu Coding Diagnostic Tools Aliexpress

Important Things In Your Payslips Need To Check Payroll Template National Insurance Number Payroll Software